Why You Should Make Your Trust the Beneficiary of Your Accounts

When people set up estate plans, they often focus on making sure their assets go directly to their loved ones. That’s why it can feel natural to list children, spouses, or other family members as beneficiaries on bank accounts, retirement funds, or investment accounts. But here’s a detail that can make your estate plan smoother, simpler, and more efficient: making your trust the beneficiary of your accounts.

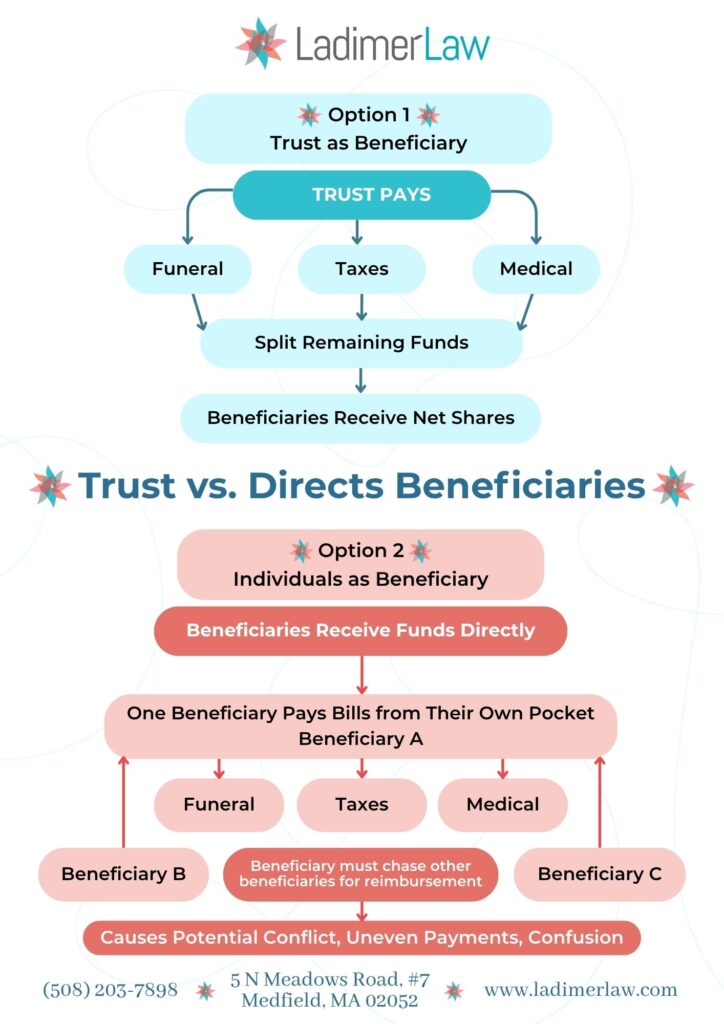

At first glance, naming individuals directly may seem easier. But in practice, leaving assets directly to beneficiaries can create unnecessary complications—especially when it comes time to pay final expenses. Naming your trust as the beneficiary ensures that your estate is handled in a way that is both practical and fair.

Let’s break down why this decision matters.

1. A Trust Provides More Flexibility Than a Simple Beneficiary Form

Most financial institutions allow you to name beneficiaries on your accounts, but those forms are limited. They usually say: “If the named beneficiary dies before you, then the account goes to their estate” or sometimes “to contingent beneficiaries.” These options are rigid and don’t account for more nuanced family dynamics or what happens if multiple beneficiaries pass away.

A trust document, however, has much more robust language. It can include:

- Backup beneficiaries if the first choice predeceases you.

- Provisions for minor children.

- Flexibility to distribute funds to multiple generations.

- Protections for beneficiaries who may need oversight, such as spendthrift provisions or special needs planning.

In short, your trust ensures that the money will flow exactly how you intend, rather than being limited by the fine print of a beneficiary form.

2. It’s Easier to Make Changes to Your Estate Plan

Life changes—families grow, relationships shift, and priorities evolve. If you’ve named beneficiaries directly on each account, then every time you change your mind about who should inherit, you need to update the beneficiary designation on every single account. That’s time-consuming, and it’s easy to overlook an account.

By contrast, if your trust is the beneficiary of all your accounts, then when you want to update your plan, you only need to make the change in one place: the trust document. This keeps your plan consistent and eliminates the risk that an outdated account designation will conflict with your true wishes. This can be daunting and time consuming when you go to update all of your beneficiaries after you execute your trust, but it’s worth it in the long run because you only have to do it once.

Unfortunately, I’ve seen many cases where clients forgot about an account, and the named beneficiaries were no longer who they intended. By the time we discovered the oversight, it was too late to fix. Naming your trust as beneficiary avoids this pitfall.

3. The Trust Simplifies Paying Expenses, Prevents Family Friction, and Provides Clear Records

End-of-life expenses add up quickly. Funeral costs, last medical bills, outstanding taxes, legal fees—someone has to pay these. If your accounts pass directly to individual beneficiaries, those beneficiaries receive the money outright, but your final bills don’t simply disappear. Instead, one responsible family member (often the executor) must chase down everyone else for their “share” of expenses. This can cause frustration, resentment, and unnecessary bookkeeping.

By contrast, if your trust is the beneficiary, the trustees have clear authority to:

- Collect all of the funds into the trust.

- Pay outstanding bills directly from the trust.

- Keep a clear paper trail of all transactions.

- Divide what remains according to your instructions.

This process is smoother, more transparent, and far less stressful for your loved ones. It also prevents unnecessary arguments. Imagine this scenario: You leave three children equal shares of your bank account. One child takes it upon themselves to cover the funeral bill. Then they must chase the other two for reimbursement. Maybe one delays, maybe another insists they already paid enough somewhere else. Suddenly, instead of grieving together, your children are arguing over money.

With a trust, this situation never arises. The trustee handles all the bills from the trust’s funds, the records are clear, and beneficiaries only receive what is left over. No one has to ask, demand, or argue over repayment. Your family is spared unnecessary conflict at an already emotional time.

Here’s a diagram to illustrate the difference:

Final Thoughts

Estate planning is about more than just naming who gets what—it’s about making the process easier for your loved ones. By naming your trust as the beneficiary of your accounts, you ensure that bills get paid efficiently, distributions happen fairly, and your family avoids unnecessary stress and conflict.

This simple but powerful choice creates a smoother, smarter plan for your legacy.

Until Next Time,

Julie

Copyright © 2014-2024 Ladimer Law Office PC

(508) 203-7898

jcampbell@ladimerlaw.com

Ladimer Law

5 N Meadows Road, #7

Medfield, MA 02052

Ladimer Law specializes in estate planning. We protect our clients, their heirs, and their assets by listening closely, knowing the law, and executing estate plans that fit and evolve.