Let’s face it: life insurance isn’t exactly the kind of topic that makes people jump out of bed in excitement. But when it comes to Massachusetts estate planning, that tidy little death benefit might be doing more than just taking care of your loved ones—it might also be setting off alarms with the Massachusetts Department […]

(…we swear we’re not your mother. But we’re giving very mother-like advice.) At Ladimer Law, we strongly recommend that once your estate planning documents are signed, you download and save electronic copies. Yes — we print your originals. Yes — we store copies for our files. But in the moment of an emergency, the person […]

Let’s be honest: no one wakes up in the morning excited to make an appointment with an estate planning attorney. We get it. The thought of talking about wills, trusts, powers of attorney, and what happens when you’re not around can be… less than thrilling. In fact, for many people, just making that first appointment […]

Estate planning isn’t anyone’s idea of a party. It involves facing uncomfortable topics—death, taxes, money, and family dynamics—all of which people would rather not think about, let alone talk about with a lawyer. But here’s the good news: getting your estate plan done doesn’t have to be miserable. In fact, with the right mindset and […]

Let’s be honest — over the years, most of us collect financial accounts like souvenirs. A checking account from your first job, a savings account from the bank down the street, a few old 401(k)s lingering from past employers, maybe an investment account or two. Before long, your finances look like a scavenger hunt across […]

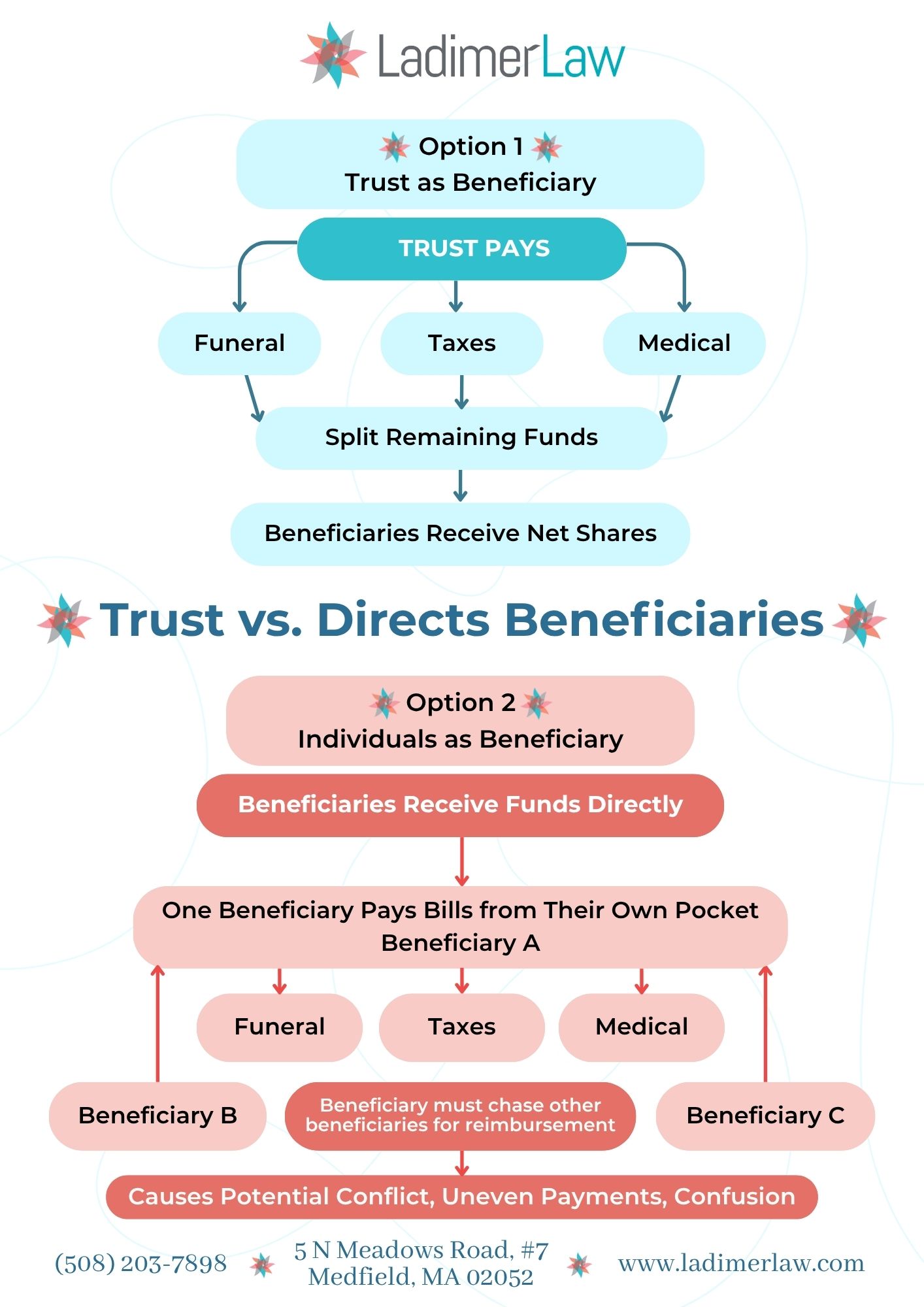

When people set up estate plans, they often focus on making sure their assets go directly to their loved ones. That’s why it can feel natural to list children, spouses, or other family members as beneficiaries on bank accounts, retirement funds, or investment accounts. But here’s a detail that can make your estate plan smoother, […]

The countdown to summer has officially begun. The days are getting longer, the weather is getting warmer, and your weekends are probably starting to fill up with cookouts, soccer games, beach trips, and summer travel plans. And if you’re like most people, the last thing you want to do once summer hits is schedule a […]

When selecting a bank for estate planning purposes, one of the most critical factors to consider is whether or not the institution allows a Transfer on Death (TOD) designation to a trust. This seemingly small detail can make a significant difference in the efficiency and effectiveness of your estate plan. In my estate planning practice, […]

In the intricate dance of estate planning, one must waltz carefully around the thorny issue of taxes. Massachusetts, like many other states, imposes estate taxes that can eat away at the legacy you’ve worked so hard to build. But fear not, for in the realm of legal strategies, there exists a charming solution: the Disclaimer […]

February 2024 Losing a loved one is an emotional and challenging time, and dealing with their financial affairs can add another layer of complexity to an already difficult situation. One of the primary concerns that arises after the passing of a family member or friend is what happens to their debts. In this article, I […]

February 2024 In the realm of estate planning, the intricacies of Massachusetts law can sometimes feel daunting. Yet, there’s a powerful tool available to residents of the Bay State that can alleviate many of these concerns: trusts. Particularly, establishing a trust in Massachusetts not only allows for the avoidance of probate but also streamlines the […]

Introduction Hey there, savvy planners! Let’s talk about a nifty tool in the estate planning game: the Transfer on Death (TOD) designation for your bank accounts. The TOD designation is essentially putting a beneficiary on your bank accounts, just like a life insurance policy. They can’t access the money until after you pass away. We […]

Phew! There has been a lot of buzz lately with the new Massachusetts estate tax threshold being changed from $1,000,000 to $2,000,000 – it’s been great news for many of our clients. When you are a Trust and Estate Attorney, dealing with death and taxes are part of everyday life, we hear bad news probably […]

Many times, clients will come to me when their parents pass away and are surprised that we must go through the probate process even though they had done their estate plan, established a trust, and even funded the trust with assets. This came up very recently with a client whose mother had passed away in […]

You don’t need an estate plan – said no estate planning attorney ever. Estate plans aren’t about how much money you have, but about making an easy transition of anything you own to the rightful owners when you pass. Practically speaking, an estate plan is about making it easy for your kids, family members, or […]