Let’s face it: life insurance isn’t exactly the kind of topic that makes people jump out of bed in excitement. But when it comes to Massachusetts estate planning, that tidy little death benefit might be doing more than just taking care of your loved ones—it might also be setting off alarms with the Massachusetts Department […]

(…we swear we’re not your mother. But we’re giving very mother-like advice.) At Ladimer Law, we strongly recommend that once your estate planning documents are signed, you download and save electronic copies. Yes — we print your originals. Yes — we store copies for our files. But in the moment of an emergency, the person […]

Let’s be honest: no one wakes up in the morning excited to make an appointment with an estate planning attorney. We get it. The thought of talking about wills, trusts, powers of attorney, and what happens when you’re not around can be… less than thrilling. In fact, for many people, just making that first appointment […]

Estate planning isn’t anyone’s idea of a party. It involves facing uncomfortable topics—death, taxes, money, and family dynamics—all of which people would rather not think about, let alone talk about with a lawyer. But here’s the good news: getting your estate plan done doesn’t have to be miserable. In fact, with the right mindset and […]

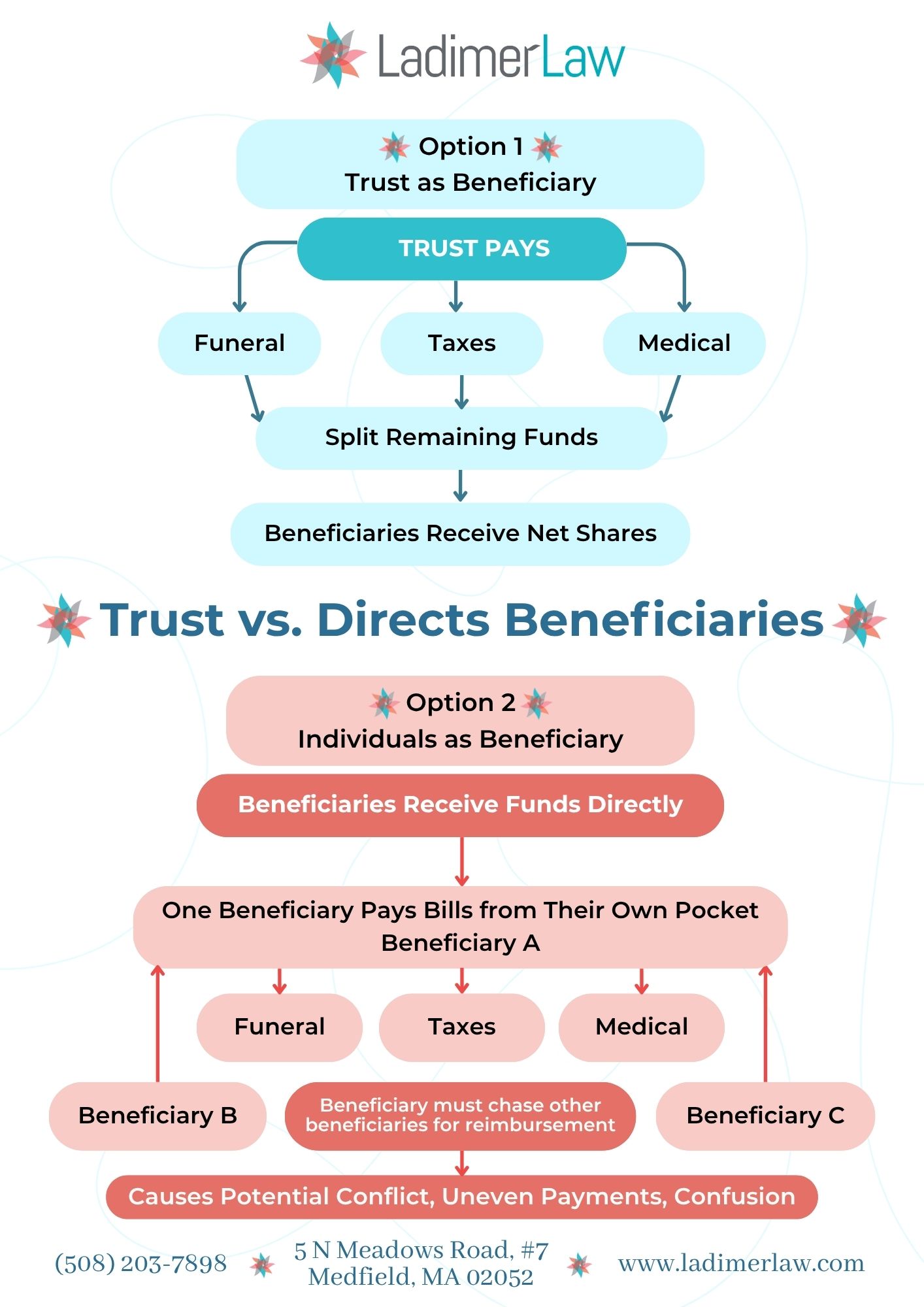

When people set up estate plans, they often focus on making sure their assets go directly to their loved ones. That’s why it can feel natural to list children, spouses, or other family members as beneficiaries on bank accounts, retirement funds, or investment accounts. But here’s a detail that can make your estate plan smoother, […]

The countdown to summer has officially begun. The days are getting longer, the weather is getting warmer, and your weekends are probably starting to fill up with cookouts, soccer games, beach trips, and summer travel plans. And if you’re like most people, the last thing you want to do once summer hits is schedule a […]

When selecting a bank for estate planning purposes, one of the most critical factors to consider is whether or not the institution allows a Transfer on Death (TOD) designation to a trust. This seemingly small detail can make a significant difference in the efficiency and effectiveness of your estate plan. In my estate planning practice, […]

When it comes to estate planning for blended families, one thing is certain: it’s complicated. Whether you’ve been married before or are bringing children, assets, and possibly a mortgage into a new relationship, figuring out how to divvy things up when you’re no longer around isn’t always straightforward. In fact, many people who’ve been down […]

Life is unpredictable, and while we all hope for the best, it’s crucial to plan for the worst. One of the most challenging yet essential decisions parents must make is deciding who will take care of their minor children if they are no longer able to. This decision requires careful thought and consideration to ensure […]

Discussing your estate plan with your family can be a sensitive and challenging conversation. However, being upfront and honest about your wishes is crucial to ensuring that your assets are managed according to your desires and that your loved ones are prepared for the responsibilities they may need to undertake. Here are some essential tips […]

When it comes to estate planning, many people tend to procrastinate. Whether it’s due to the discomfort of contemplating mortality or the misconception that estate planning is only for the wealthy, putting it off can lead to significant issues down the line. At Ladimer Law, we understand the complexities and sensitivities involved in estate planning […]

Welcome to the wonderful world of estate planning, where good intentions sometimes lead to less than desirable but avoidable mishaps. If you’ve ever chuckled at a comedy of errors, you’ll appreciate this tour of the five cardinal sins of estate planning. With a touch of wit and a nod to those who’ve blundered before, let’s […]

In the intricate dance of estate planning, one must waltz carefully around the thorny issue of taxes. Massachusetts, like many other states, imposes estate taxes that can eat away at the legacy you’ve worked so hard to build. But fear not, for in the realm of legal strategies, there exists a charming solution: the Disclaimer […]

February 2024 Losing a loved one is an emotional and challenging time, and dealing with their financial affairs can add another layer of complexity to an already difficult situation. One of the primary concerns that arises after the passing of a family member or friend is what happens to their debts. In this article, I […]

February 2024 In the realm of estate planning, the intricacies of Massachusetts law can sometimes feel daunting. Yet, there’s a powerful tool available to residents of the Bay State that can alleviate many of these concerns: trusts. Particularly, establishing a trust in Massachusetts not only allows for the avoidance of probate but also streamlines the […]

Introduction: Estate planning is a crucial aspect of managing one’s assets, ensuring they are distributed according to one’s wishes, and minimizing potential legal complications for heirs. Two commonly used strategies in estate planning are life estates and trusts. In this article, we will explore why putting your home in trust may be a more advantageous […]

Introduction Hey there, savvy planners! Let’s talk about a nifty tool in the estate planning game: the Transfer on Death (TOD) designation for your bank accounts. The TOD designation is essentially putting a beneficiary on your bank accounts, just like a life insurance policy. They can’t access the money until after you pass away. We […]

Introduction: Parenthood is a thrilling journey filled with joy, laughter, and countless precious moments. Yet, amid the chaos of hockey practices, school projects, and bedtime stories, many parents in Massachusetts overlook a critical aspect of responsible parenting – having a comprehensive estate plan in place. Picture this: you’re ensuring your child wears a helmet while […]

Hello Friend! I hope your holiday season has been stress-free and filled with good times so far! I’m reaching out to address a question I have been receiving about the upcoming webinar in January. People have been asking ‘What’s the difference between the Wills in a Week program and this webinar?’ First, the webinar is […]