Let’s face it: life insurance isn’t exactly the kind of topic that makes people jump out of bed in excitement. But when it comes to Massachusetts estate planning, that tidy little death benefit might be doing more than just taking care of your loved ones—it might also be setting off alarms with the Massachusetts Department […]

Let’s be honest — over the years, most of us collect financial accounts like souvenirs. A checking account from your first job, a savings account from the bank down the street, a few old 401(k)s lingering from past employers, maybe an investment account or two. Before long, your finances look like a scavenger hunt across […]

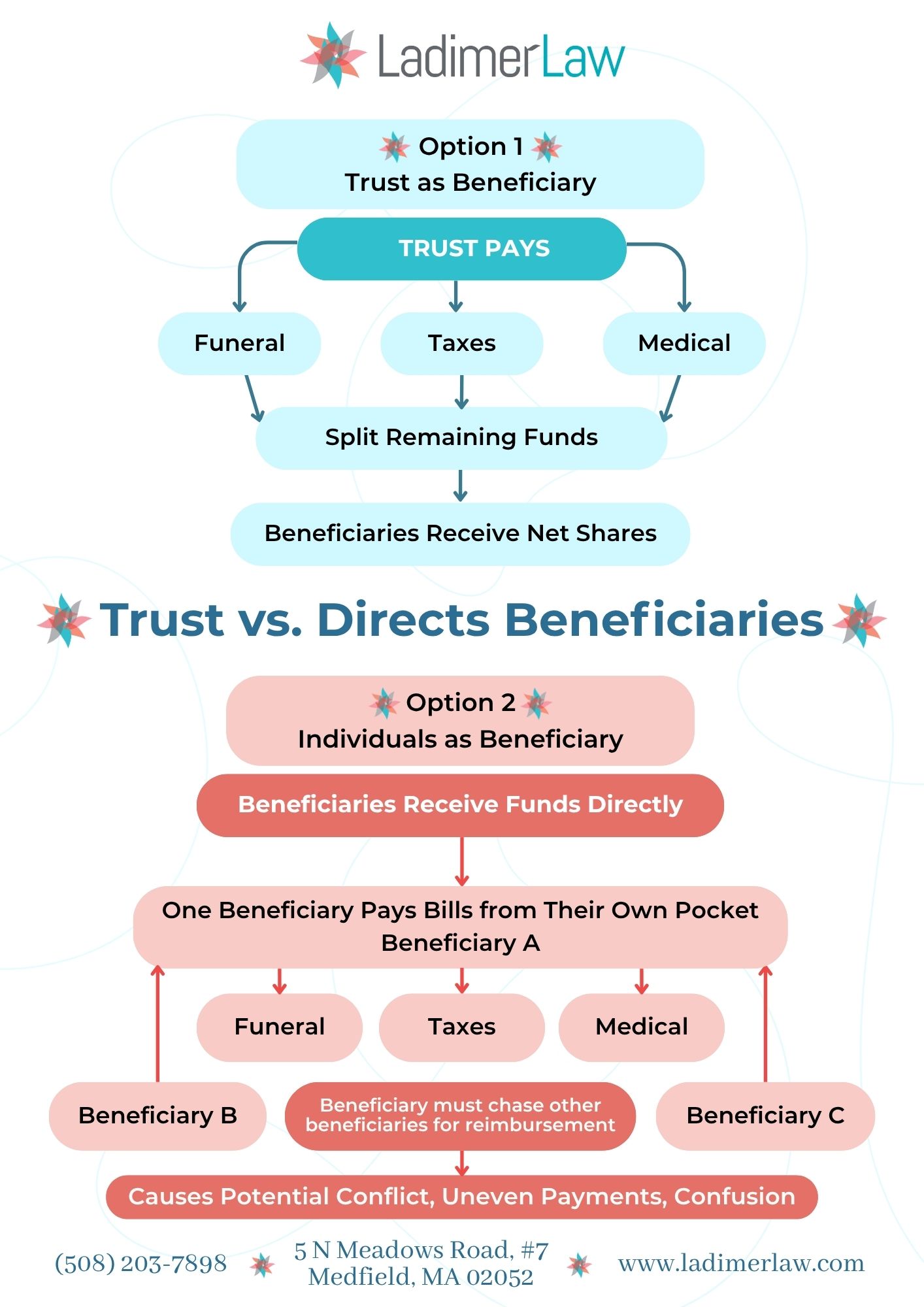

When people set up estate plans, they often focus on making sure their assets go directly to their loved ones. That’s why it can feel natural to list children, spouses, or other family members as beneficiaries on bank accounts, retirement funds, or investment accounts. But here’s a detail that can make your estate plan smoother, […]

In the intricate dance of estate planning, one must waltz carefully around the thorny issue of taxes. Massachusetts, like many other states, imposes estate taxes that can eat away at the legacy you’ve worked so hard to build. But fear not, for in the realm of legal strategies, there exists a charming solution: the Disclaimer […]

In the intricate realm of estate planning, the objective is often to safeguard assets, streamline distribution, and mitigate the complexities of probate. However, even the most meticulously crafted estate plans may encounter unforeseen challenges, as demonstrated by a recent scenario involving one of our clients. Meet Mrs. Smith, a woman who, proactively planning for the […]

February 2024 In the realm of estate planning, the intricacies of Massachusetts law can sometimes feel daunting. Yet, there’s a powerful tool available to residents of the Bay State that can alleviate many of these concerns: trusts. Particularly, establishing a trust in Massachusetts not only allows for the avoidance of probate but also streamlines the […]

Introduction: Parenthood is a thrilling journey filled with joy, laughter, and countless precious moments. Yet, amid the chaos of hockey practices, school projects, and bedtime stories, many parents in Massachusetts overlook a critical aspect of responsible parenting – having a comprehensive estate plan in place. Picture this: you’re ensuring your child wears a helmet while […]

Hello Friend! I hope your holiday season has been stress-free and filled with good times so far! I’m reaching out to address a question I have been receiving about the upcoming webinar in January. People have been asking ‘What’s the difference between the Wills in a Week program and this webinar?’ First, the webinar is […]

Phew! There has been a lot of buzz lately with the new Massachusetts estate tax threshold being changed from $1,000,000 to $2,000,000 – it’s been great news for many of our clients. When you are a Trust and Estate Attorney, dealing with death and taxes are part of everyday life, we hear bad news probably […]

Trusts are legal entities, like an LLC or a corporation. You can place assets into trust, and you can take assets out of trust. You place assets into trust by retitling the asset. For example, your checking account statement comes with your name and address on it. When you go to the bank and fill […]

If you have life insurance, you should also have an estate plan. One of the first things people do when they have a baby or purchase a home is get life insurance. Life insurance can cover significant expenses if you pass away and give you peace of mind when thinking about an unexpected death. But […]

Getting old sucks. There is no way around it. We can eat as many antioxidants and exercise every day, but the fact of the matter is we all are getting older every day. And we all age at different rates. In the modern days, women have statistically outlived men. Traditionally, the men took care of […]

Here’s a very basic overview of the Massachusetts Estate Tax This may or may not come as a shock to you, but Massachusetts has one of the lowest estate tax thresholds in the United States. We aren’t called Taxachusetts for nothing! Here is an over simplified explanation of whether or not your family will owe […]

Valentine’s Day is often thought of as a day of love shared between couples. This holiday can, however, also be viewed as a day for giving thanks and showing your family how much you love them. Many people today have not taken the time to leave clear instructions for their estates should something happen to […]