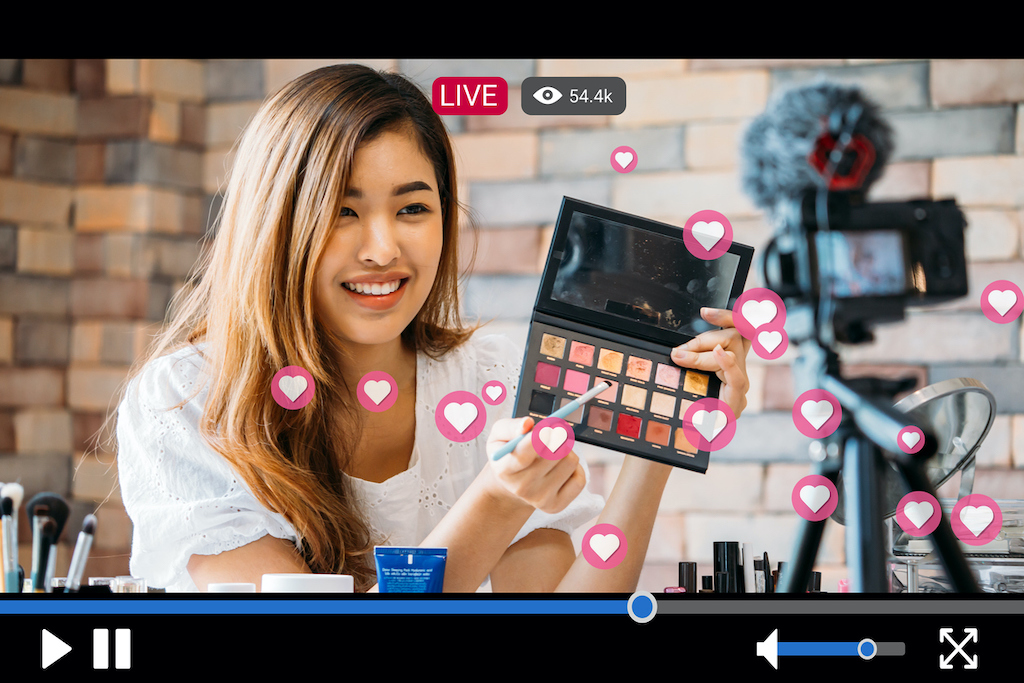

Social media has opened up amazing new revenue streams for all sorts of creative people. If you’re an influencer, chances are good that you are taking care of business, and working with an attorney to protect your content and your brand. But have you thought about what happens to your brand in the event you […]

Do an image search for “estate planning” and you’ll likely see lots of pictures of couples, some young, some older, many with kids. But singles – many without kids – have specific estate planning needs that shouldn’t be ignored. Just because you don’t have a spouse or kids doesn’t mean you don’t have plans for […]

The COVID-19 pandemic has changed the way everyone does business. While we still love to see our clients in person, we’ve found that more often, folks ask to conduct their estate planning consult over Zoom. Virtual appointments are different, for sure, but also offer a great opportunity to be more flexible. Still, it’s easy to […]

You know it is important to plan for your future: college for the kids, retirement, and security for your family should anything happen to you. We hear all the time that the whole things seems so overwhelming – and often, people just put it off because it just seems so daunting. But once you’ve decided […]

Google the phrase “Estate Planning Mistakes” and you’ll see pages of results. Seems like attorneys and financial planners are always telling their clients how to avoid one mistake or another as they put together their estate plan. But in the end, the single biggest mistake you can make is all about what you DON’T do. […]

While married couples have different priorities than their single counterparts, one thing is certain: anyone – whether they have a family or not – needs to think about estate tax planning. In fact, planning one’s own estate taxes as a single person might be more important than it is for a married couple. Why? As […]

You’ve often heard that when it comes to gift-giving, it’s the thought that counts. Unsurprisingly, the IRS doesn’t agree. To them, all that matters is that gifts are properly reported and taxed. Gift taxes are only required on gifts of significant financial value, so many people will never have to pay them. But if your […]

A new administration generally means new tax laws. So in these last few months, I’ve heard from many clients with questions about how the Biden presidency will affect them. I was recently asked about the potential repeal of the policy that allows step-up in basis, and wanted to share some thoughts with anyone who’s concerned […]

The phrase “death tax” might send a little shiver down your spine. It sounds like something out of a futuristic sci-fi story, or maybe a horror movie about killer accountants. In reality, the U.S. tax code doesn’t specifically mention death taxes. Death tax is an umbrella term that’s colloquially used to describe taxes that kick […]

When you give the perfect gift, you want to bask in the recipient’s excitement—not fill out a gift tax return. I know there’s a lot of confusion around the gift tax, especially around the holidays. Federal gift tax law does require certain gifts to be reported and taxed, with the onus on the giver. Fortunately, […]

After years of helping clients navigate Massachusetts estate planning, I know how much stress and confusion the Massachusetts estate tax can cause Commonwealth residents. People tend to come to me armed with a lot of questions about exactly how this tax will affect them. Will my estate owe this tax? If I’m someone’s executor, what […]

The estate tax is a tax that’s levied on a person’s estate when they die and their assets are transferred to their heirs. How much of what you’ve earned will go to estate taxes when you die? These taxes may cost some immigrant families more than they do other American families, so it’s critical to […]

You didn’t get married for the tax perks – but, hey, it’s not like you’re going to turn them down. In this state, like many others, married couples can benefit from special tax provisions in a variety of areas, including the Massachusetts estate tax marital deduction. The deduction available to married American couples can help […]

For years and years, you and your spouse have worked to provide for your children. Year after year – while you kept them clothed and fed, doled out advice and enforced rules – you were also providing for your kids by maintaining your life insurance policy or policies. When you die, the death benefits from […]

No one wants to think about losing their beloved parents. That’s as true of kindergarteners as it is of grown adults with families of their own. Children of all ages can handle some frank discussion about their parents’ estate planning, though, and in fact may be reassured to know that you’re on top of your […]

A new year means new resolutions, new calendars, new deductibles on your health insurance – and, of course, new tax law. The nuances of the current estate tax laws might not affect your daily life. But if you or a loved one die this year, the estate tax exemption for 2020 will suddenly become incredibly […]

Buying life insurance is supposed to be a way to provide financial security for the people you leave behind. If that expensive policy actually triggers an estate tax to be levied against your estate, is there any point in buying life insurance at all? The answer is yes, but only if you know how to […]

Yachts, ski chalets, chartered jets, trusts: one of these things is not like the others. Contrary to popular belief, establishing a trust isn’t a luxury reserved for the ultra-rich. Yes, trusts are often used by the wealthy to shield assets and pass money from one generation to the next. That’s just one way that trusts […]