Estate Plans Help Loved Ones Avoid Probate When someone passes away, they often leave an estate behind. That estate can consist of various types of property that may include little things such as digital accounts, cash, and cars, and larger assets such as stocks, bonds, business interests, and real estate. Someone who has planned ahead […]

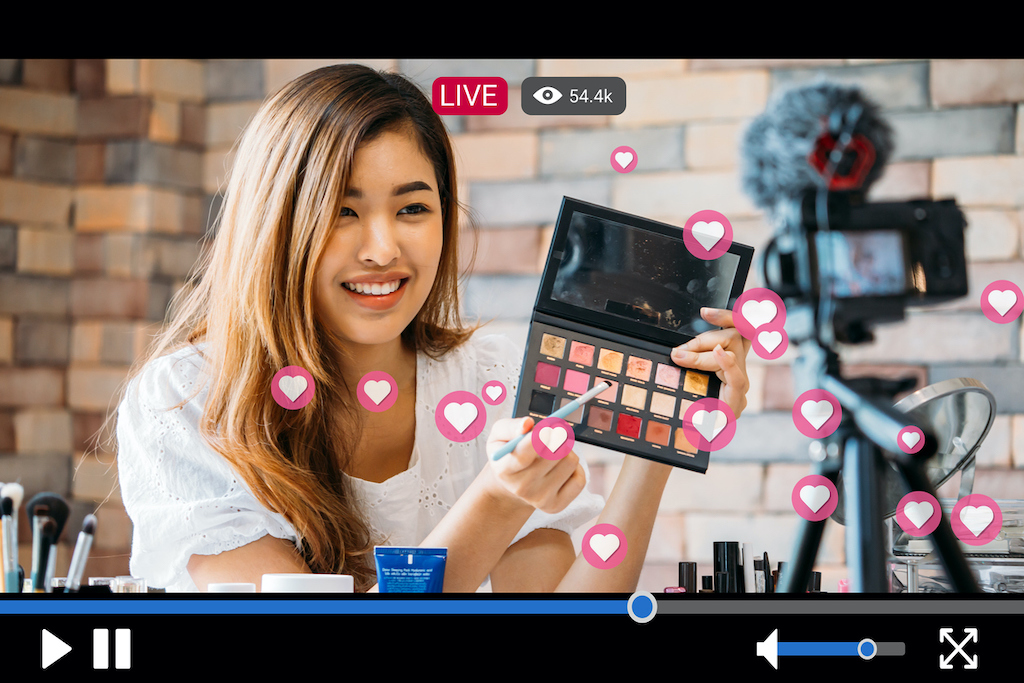

Social media has opened up amazing new revenue streams for all sorts of creative people. If you’re an influencer, chances are good that you are taking care of business, and working with an attorney to protect your content and your brand. But have you thought about what happens to your brand in the event you […]

Do an image search for “estate planning” and you’ll likely see lots of pictures of couples, some young, some older, many with kids. But singles – many without kids – have specific estate planning needs that shouldn’t be ignored. Just because you don’t have a spouse or kids doesn’t mean you don’t have plans for […]

The COVID-19 pandemic has changed the way everyone does business. While we still love to see our clients in person, we’ve found that more often, folks ask to conduct their estate planning consult over Zoom. Virtual appointments are different, for sure, but also offer a great opportunity to be more flexible. Still, it’s easy to […]

You know it is important to plan for your future: college for the kids, retirement, and security for your family should anything happen to you. We hear all the time that the whole things seems so overwhelming – and often, people just put it off because it just seems so daunting. But once you’ve decided […]

Google the phrase “Estate Planning Mistakes” and you’ll see pages of results. Seems like attorneys and financial planners are always telling their clients how to avoid one mistake or another as they put together their estate plan. But in the end, the single biggest mistake you can make is all about what you DON’T do. […]

Understanding how to protect your assets as you age is a critical component of estate planning. In addition to navigating estate taxes, beneficiaries, and who will be responsible for your medical decisions should you be unable to make them yourself, it is also critically important to look ahead and think about long-term care coverage as […]

While married couples have different priorities than their single counterparts, one thing is certain: anyone – whether they have a family or not – needs to think about estate tax planning. In fact, planning one’s own estate taxes as a single person might be more important than it is for a married couple. Why? As […]

Americans are living longer than ever. As we age, there are myriad things we need to think about: downsizing or managing our homes, how we’ll spend our retirement, our finances, who will care for us when we can no longer care for ourselves and more. Long-term care insurance should also be on that list. Even […]

You’ve often heard that when it comes to gift-giving, it’s the thought that counts. Unsurprisingly, the IRS doesn’t agree. To them, all that matters is that gifts are properly reported and taxed. Gift taxes are only required on gifts of significant financial value, so many people will never have to pay them. But if your […]

Hopefully, you’ll never be in a car accident. You still have car insurance, just in case. And hopefully, you’ll never be incapacitated and be unable to make decisions for yourself—but just in case, you should have a power of attorney and health care proxy. They’re essential estate planning documents for all adults. Even an 18-year-old […]

Estate planning combines legal, financial and emotional decision making. Drawing on the help of trusted advisors is the best way to make sure your estate plans will actually do what you want them to do. As your estate planning attorneys help you sort through your choices around trusts, wills and other estate planning documents, a […]

You’ve spent decades taking care of your most treasured possessions and working to grow your wealth. All that care wasn’t just about protecting those things during your lifetime, but preserving them for the next generation. Sometimes understanding the laws in this area can be confusing. A common misconception is that there are specific inheritance laws. […]

Mistakes happen. If you’re lucky, most of your mistakes will have minor consequences. Making a wrong turn adds 15 minutes to your trip. Forgetting to return a shirt that doesn’t fit means you’re stuck with it, and out $50. But estate planning mistakes are rarely minor or cheap, and their consequences can sometimes affect your […]