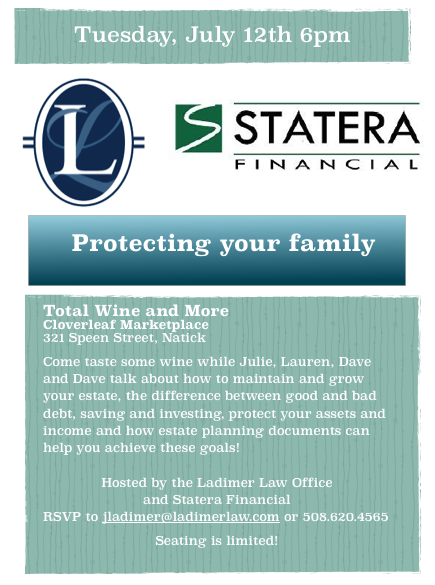

Total Wine and More Cloverleaf Marketplace 321 Speen Street, Natick Come taste some wine while Julie, Lauren, Dave and Dave talk about how to maintain and grow your estate, the difference between good and bad debt, saving and investing, protect your assets and income and how estate planning documents can help you achieve these goals! […]

As our clients get older, many worry about leaving a legacy for their children. Some have heard stories of someone they know losing their life savings to the costs of long-term care in a nursing home. While there are various planning techniques to help shelter assets from the costs of long-term care, a long standing […]

The Board of Directors of the Central Mass Chapter of the Society of Financial Service Professionals cordially invites you to a live video stream broadcast – “A Financial Professional’s Ultimate Survival Guide for the Challenging New Fiduciary Landscape”. A distinguished panel will explore the ramifications of the new DOL decision and help advisors comply with […]

Many people find an estate planning attorney when they are ready to establish a plan. They meet with the attorney, develop a plan, review drafts, and then execute the documents which will carry our their plan. However, many people do not stay in touch with their estate planning attorney. Life goes on and they think […]

The majority of estate plans these days incorporate a trust in one way or another. One of the biggest decisions clients make is choosing a trustee to serve once they have passed away. The two most common options are a trusted family or friend, or a professional such as a bank or attorney. The trustee’s […]

Estate planning can be an overwhelming process for many people. Deciding who will inherit your assets and who will be in charge of handing your estate after you die are not easy decisions. Sometimes clients find themselves so overwhelmed with these decisions, that they have never executed an estate plan. While there are important reasons […]

If you are concerned that you or a loved one will need long term nursing care, it is important to start planing now. Skilled nursing facilities are quite expensive if you pay privately. There are federal and state benefits, known as Medicaid, that will pay for your long term care in a skilled nursing facility. […]

The estate tax is a tax that is not always on the top of people’s mind. However, here in Massachusetts, we have a 1 million dollar exemption, which is much lower than the 5 million dollar federal exemption. Therefore, planning to avoid estate taxes affects more middle class people in Massachusetts than elsewhere.

A Will is a legal document that allows a person, the testator, to decide how his or her estate will be distributed after death. While this concept seems simple, it is not. In Massachusetts, Wills have many requirements and should always be drafted by an attorney. Here are five common misconceptions about Wills.

Ladimer Law Office is pleased to participate in the following event: Tuesday June 3, 2014Come join us for our Annual Worcester Chapter FSP EventPlanting the Seed – Succession Planning and GrowthGuest Speaker: Peter Mezitt from Weston Nurseries Weston Nurseries a 4th generation business priding itself on proper succession planning and exceptional customer service aiding […]

Every trust has three components, a Settlor (a/k/a donor, trustor, or grantor), a Trustee, and a Beneficiary. The Settlor creates the trust and transfers the asset to be held in the trust to the Trustee. The Trustee is an individual (or an institution, such as a bank) who has legal capacity to act as a […]